Preface: This article is a modified version of a book sharing document from a company meeting.

Book Introduction#

This is a book with a theoretical and academic nature, with many experiments and papers. The advantage is that it can explain some theories with clear logic and experimental conclusions, but the disadvantage is that it is relatively dry and some chapters are difficult to understand.

Authors#

Both authors are researchers in cognitive psychology and decision-making studies.

Reid Hastie graduated from the University of California, San Diego and Yale University, and began his academic career at Harvard University. He actively sought opportunities for research outside of academia and conducted research on medical and legal decision-making in hospitals and courts. His research interests lie in the application of cognitive psychology methods and theories to judgment and decision-making. He has devoted his life to research in real-life situations, including medical decision-making, legal decision-making, weather forecasting, consumer and business financial decision-making, and other fields.

Robyn M. Dawes received a Bachelor of Philosophy from Harvard University in 1958 and then entered the Clinical Psychology Department at the University of Michigan. Two years later, he entered the Mathematical Psychology Department (received a Ph.D. in 1963) with an interest in behavioral decision-making, social interaction, and attitude measurement, and completed his graduate education in mathematics. In the fall of 1985, he transferred to Carnegie Mellon University and became a psychology professor in the Social and Decision Sciences Department. He is currently a professor at Charles J. Queenan, Jr. University. Dawes has published over 150 papers and authored 6 books.

Why Read?#

- Interested in social science and psychology books

- How to make decisions, especially in an uncertain world

Post-Reading Sharing#

This book has a lot of content, but to summarize, it basically talks about three things: rational decision-making, what it is, why irrational decision-making occurs, and how to do it.

What is it?#

Criteria for a rational decision:

- Based on the current situation of the decision-maker: psychological, material, environmental, etc.

- Based on the possible outcomes of the choices (goals)

- Evaluate possibilities using probabilities

- Adaptive, considering the range of influences

Decision-making is a set of decisions with long-term impacts; making a decision is the allocation of resources. The existence of a decision requires the following conditions:

- Selectivity

- Limited resources

- Clear goals

Why?#

Why learn to judge rationally? There is uncertainty in the external world, and we ourselves have cognitive biases and irrational behaviors when making judgments. The book lists some common cognitive biases:

-

Sunk Cost Fallacy

- Costs that have already been incurred. Overly focusing on sunk costs means focusing on the past and the confirmed losses. Rational decisions should be based on future consequences. (Example: "Since I'm already here, I might as well stay and finish it," "I bought something, so I have to finish it even when on a diet.")

-

Availability Bias

- For judgments made intuitively, we tend to remember the successful parts and "explain away" the failures. (Example: Judging a mentally ill person by a doctor, if misdiagnosed, a normal person will be sent to a mental hospital and may eventually commit suicide due to the burden, and the doctor explains it as: the judgment was correct, the person is mentally abnormal; Waiter saying they can judge who gives more tips, if they give more tips, it means they provided good service, and vice versa.)

-

Confirmation Bias: Seeking evidence to justify oneself. (For example, when deciding to buy a certain brand of car, one will collect various advantages of that brand to convince oneself.)

-

Anchoring Effect, Primacy Effect

- In uncertain situations, if an anchor appears, it will affect our judgment, and we will adjust our judgment based on this anchor. (Example: Selling clothes at a high price and then lowering the price creates the illusion of getting a bargain; Negotiating compensation amounts, "the more you ask for, the more you get.")

- Self-Anchoring: Self-centered inference, tending to speculate about others from one's own perspective, to the point where probabilities are overestimated in certain situations.

- Present Anchoring: Past memories are often "anchors" based on current beliefs and feelings, leading to selective bias. (Example: When recalling, reinforcing favorable aspects; after a caterpillar becomes a butterfly, habitually believing it has always been a butterfly. - "Adaptation to Life," maturity makes us liars.)

-

Causal Inference Based on Simple Cause and Effect Rather Than Probability

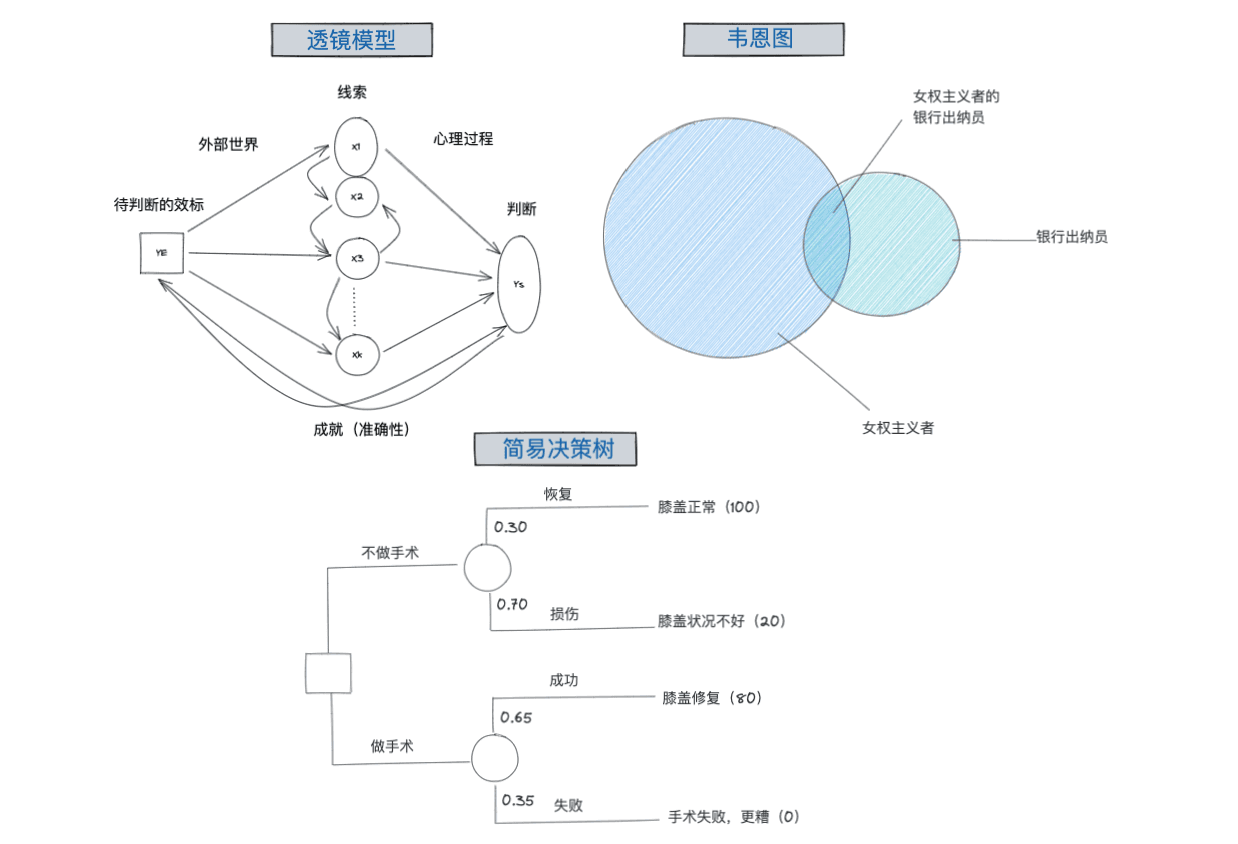

- From specific to general, from individual to collective. (Example: If a medicine cures a disease after taking it, then the medicine can treat the disease; "People in this place can eat spicy food" based on the fact that this person can eat spicy food; the example of the Linda role, actively participating in the feminist movement bank tellers are a subset of bank tellers.)

- Gambler's Fallacy: If independent events occur continuously, then the timing of the next event is "ripe," when in reality the probability remains constant.

-

Preference for Biased Stories or Logically Consistent Stories

- For example, in "The Shawshank Redemption," Andy's calm and rational statement in court is contrasted with the descriptive story of the opposing lawyer; Freud's theory of causality: current suffering stems from childhood misfortunes. This involves the bias of "present anchoring." A professor once said, "If a historical account seems logical, it's probably false; failure is attributed to external factors, success is attributed to oneself."

How to Do It?#

In order to guide ourselves back from the detours of relying on intuition, connections, and imagination, we need analytical thinking, thinking like a probability theorist.

The book gives examples and uses the lens model (clues and quality that influence decision-making), decision trees, and Venn diagrams (set relationships) to assist in decision-making:

- Consider environmental factors

- Think rationally using probability

- Use the MECE principle to exhaust all possibilities

In addition, decision-making is an evolving process and not a one-time action. Just like Bezos' one-way door, two-way door theory.

At the end of the book, the author asks us to have a proper attitude towards "uncertainty." In short, understand it, comprehend it, forgive it.

Rationality and irrationality are not absolute. "The world is rational, but our perception of the world is emotional."