When it comes to keeping accounts, many people's first reaction is, "Why bother keeping track of where all the money goes if it's already spent?" I must admit, I used to think the same way for a long time. However, after starting work, I always felt like my money was disappearing without a trace, and I had no idea where it was going. This was very frustrating. I am a meticulous person who likes to plan and expects things to go according to plan. So, I gradually started looking for a suitable solution.

Introduction to Keeping Accounts#

In general, there are two main types of keeping accounts:

- Keeping accounts in a notebook

- Keeping accounts with software

Some people might say that keeping accounts in a notebook is too old-fashioned. But the first time I encountered keeping accounts, it was actually with a small notebook. This takes me back to a stormy night in Guangdong eight years ago... I was working there during the summer, and my bunkmate used a small notebook to record his daily expenses in great detail. I asked him why he kept such detailed records, and he replied, "I'll go home once I save up fifty thousand yuan." Believe it or not, fifty thousand yuan was quite a lot of money back then. I wonder if that guy has gone home now.

Speaking of keeping accounts in a notebook, although it gives you a sense of reality and allows you to clearly see how every penny is spent, it also has many disadvantages:

- Inconvenient to carry around

- Not easy to save

- Difficult to check and analyze

- Time-consuming

On the other hand, software for keeping accounts does not have these disadvantages, and it even has advantages in these areas. After comparing different options, I finally chose the "Qianji" app. I was mainly attracted to its simple and ad-free interface, visually appealing visualizations, and most importantly, the fact that it was developed by an independent developer. I tend to prefer products made by independent developers because most developers are genuinely creating valuable products rather than seeking profit. The difference in essence determines the taste of the product.

I was an early user of "Qianji" and have been using it since the beta testing phase. I have also provided some suggestions for the product on Coolapk and in the developer's group. I have witnessed this product go from being usable to being useful. So, why did I give up using the software after using it for several years and switch to Google Sheets? This brings us to an essential aspect of keeping accounts - budgeting.

Why Budgeting?#

Those who have kept accounts before know that if you only keep track of expenses without budgeting, it doesn't have much practical use. At most, you will know where the money went, but that's about it. Budgeting is different. You must set a budget for the next month at the end or beginning of each month. In my case, I refer to the expenses of the previous month and consider any major expenses that may occur in the next month, such as buying a camera or paying rent.

The ideal situation is to have a range of fluctuations where Budget - Actual Expenses = Controllable Range. We need to keep the fluctuations as small as possible. For keeping accounts and budgeting, you can understand it this way: keeping accounts helps us understand the past, while budgeting helps us plan for the future. I believe the latter is more important.

How to Budget#

When I budget for expenses, I follow these steps:

- Divide expenses into major categories.

- Refer to previous month's spending and allocate a budget for each category based on quantitative analysis.

- Plan for non-routine expenses in the next month and add them to the corresponding categories.

There are a few principles to keep in mind:

- Include every expense, no matter how small.

- For non-routine expenses, make special notes and see if they can be covered by other sources of income later.

- The total budget should not exceed the income. Prioritize expenses and allocate lower priority expenses to other times to avoid excessive spending.

In fact, after doing it for a while, I realized that everyday expenses can be categorized into a few major categories: rent, meals, snacks and fruits, coffee and milk tea, transportation, etc. There's no need to be too detailed, as it would be troublesome when keeping accounts, and the analysis later on would not be simple either. For example, for transportation, I put all transportation expenses into this category, such as taxi fares, subway fares, and even purchasing shared bike memberships.

Review and compare regularly, and make adjustments as necessary. After a few months, you will gradually get the hang of it and get closer to your actual expenses.

Income follows the same principle, although it is much simpler with only a few sources.

Choosing the Right Tool#

As the saying goes, "A good workman always has good tools." A suitable tool is essential.

As mentioned earlier, the reason I gave up on "Qianji" was because it didn't have a budgeting tool, or it wasn't user-friendly enough. So, are there any good tools on the market? To find a suitable tool, you must first determine your own needs:

- Easy budgeting and keeping accounts

- Syncing across multiple devices, with the ability to keep accounts on your phone and analyze/budget/manage data on your computer

- Data security assurance, with the software not disappearing after a year or two

- A clean and visually appealing interface, especially without ads (even with a subscription)

- High level of customization, allowing you to configure it according to your needs

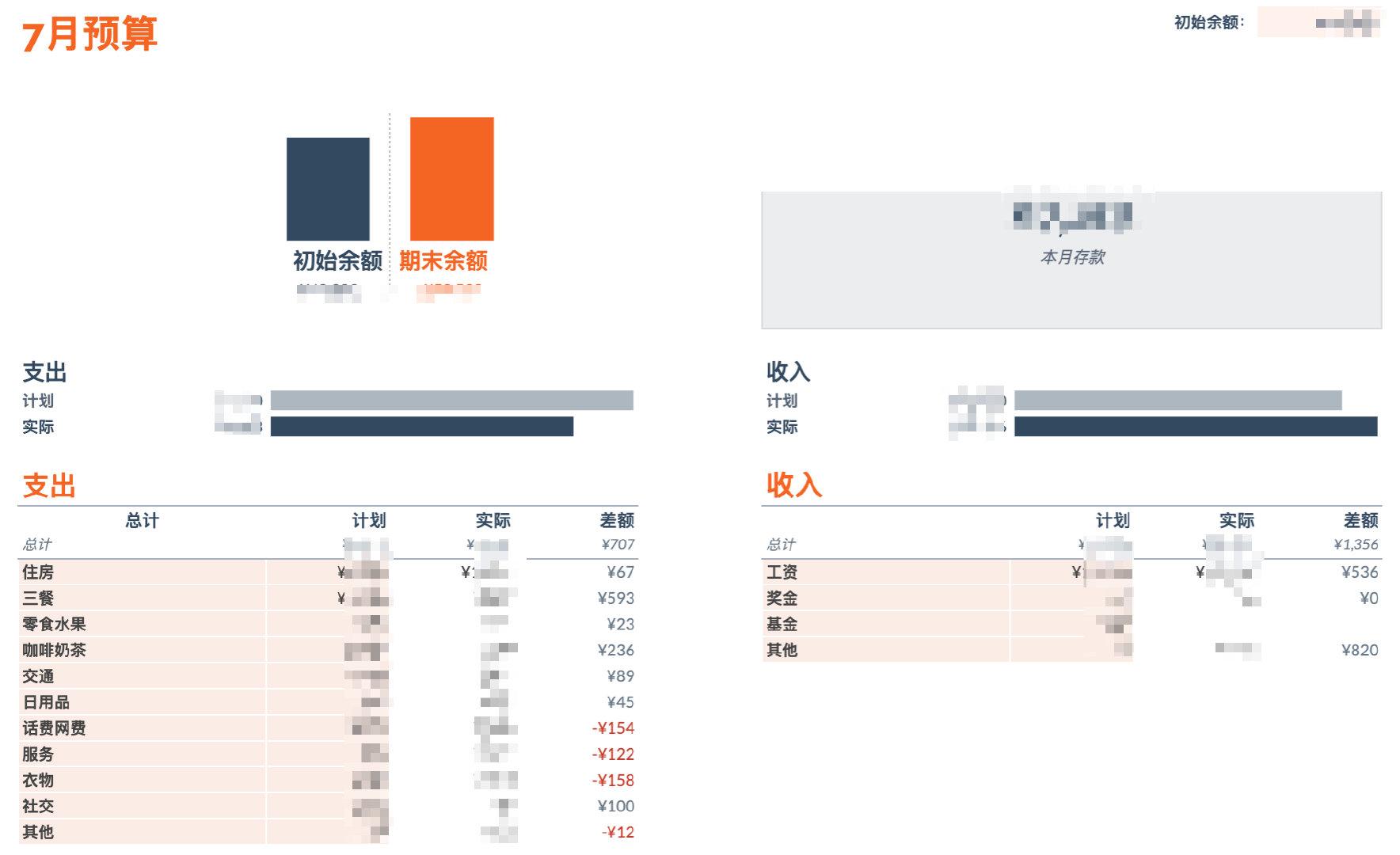

After searching around, including some highly recommended professional budgeting and accounting software, I was not completely satisfied with the results. It wasn't until one day when I was using Google Sheets for project management that I had a sudden idea - why not create my own budget template and expense tracker template? I wanted syncing, charts, and the ability to analyze data in any way I wanted. There is no higher level of customization and professionalism than this.

So, I got to work on creating a template, but I found that there was already a built-in template. So, I made some modifications to make it suitable for myself. After using it for several weeks, the results have been quite good.

When I used "Qianji" before, although it was quick to keep accounts, there was no comparison. I only knew how much money I spent. But now, whenever I make a purchase, I open Google Sheets on my phone, quickly record it, occasionally switch to see the comparison between the budget and actual expenses for certain categories this month, and then decide whether I need to adjust my spending. In practice, it has been effective. For example, this month, because I exceeded my budget by buying clothes and purchasing a lifetime subscription to Eudic, I reduced my expenses in other categories, such as cutting back on coffee and milk tea, in order to avoid excessive spending at the end of the month.

Conclusion#

In short, here are the steps:

- Set a budget.

- Spend according to the budget while keeping accounts.

- Adjust your spending based on the accounts.

- Analyze and reflect, and plan the next budget.

Budgeting and keeping accounts have truly changed my life to some extent. It not only helps me understand where my money goes, but also allows me to have a clearer picture of my expenses and develop good spending habits. In a certain sense, it makes me feel like I have some control over my life, just like creating a product where I can control its positioning and features. It's an indescribable experience.